About the sector

Market Analysis and Reports

This section includes market information based on external reports providing relevant data and links of interest for CEM-WAVE’s partners and stakeholders.

Size of the market

According to Markets and Markets the size of the global ceramic matrix composites market is projected to grow from USD 8.8 billion in 2021 to USD 25.0 billion by 2031, at a compound annual growth rate (CAGR) of 11.0%. Despite the COVID-19 ongoing pandemic, which impacted supply chains at the global level, the recovery of the global economy is expected to further stimulate the demand for ceramic matrix composite materials (CMCs) due to the raise in demand from various industries, and the flexibility in their application.

In particular, the demand is growing for defence-related applications (i.e., sensor protection, infrared domes, and multi-spectral windows), which go beyond the classical high-end use in aerospace, aviation, automotive and thermal management. The disruption might be due to different factors according to Grand View Research

One is the ongoing research focusing on finding more efficient and less expensive ways to produce resistant CMCs. If the ceramic fibres as well as the matrix manufacturing processing costs will decrease, then CMCs could have a significant impact on a much larger palette of industrial applications with a particular focus on energy-intensive sectors.

The second factor is related to the technological developments in metal mining and joining technologies. The rise in customer preference and intense competition are also influencing companies to speed up their research and development (R&D) efforts, and bring up significant technological advances. This is also linked to the increasing use of CMCs for improved performance in sturdy structures and higher comfort in those applications that require thermal management, like electronics and high-end sports equipment. Many, R&D activities are being supported by Western nations through public-private partnerships, public funding (i.e., EU-financed innovation projects) and joint ventures.

The fact that CMCs can be fully functional at very high temperatures with little or no cooling makes them suitable substitutes for metal components and conventional alloys, with the results that several global companies are investing in developed and developing countries to cater for the growing demand from different industries.

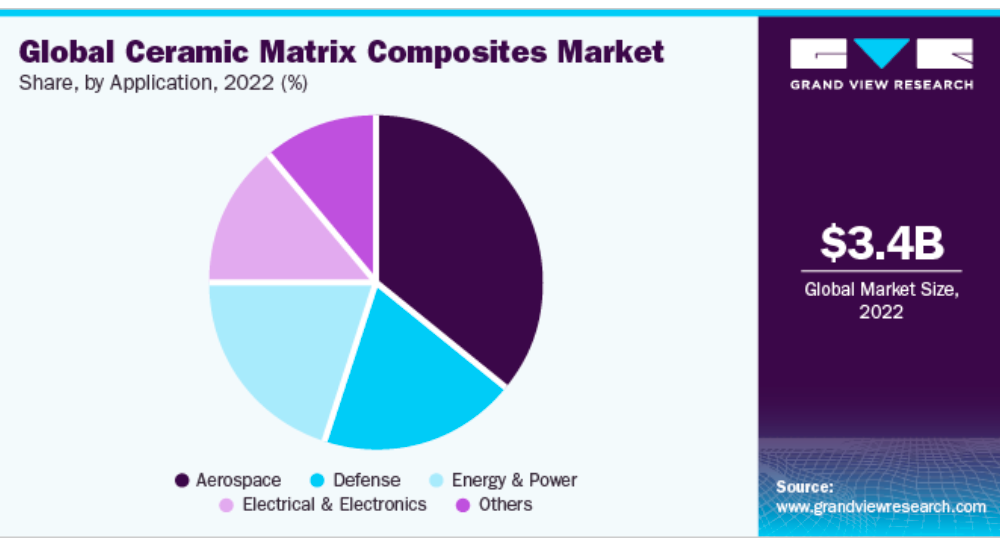

In 2018, the largest application segment was aerospace. At a global level, it accounted for 36.32% of the total market share by volume. CMCs are widely used for manufacturing aircraft components such as nose caps, rudder, fins, exhaust nozzles, leading edges, body flaps, gas turbine engines, panels, and other engine components. As mentioned, the defence application segment is expected to expand in terms of volume by 2025 (at a CAGR of 14.3%). The characteristics that are anticipated to propel the product demand for this application are the lightweight and high-temperature resistance of CMC materials. However, the energy and power sector, the electronic, industrial application (i.e., steelmaking) and marine industries are covering a large quota of the forecasted market potential.

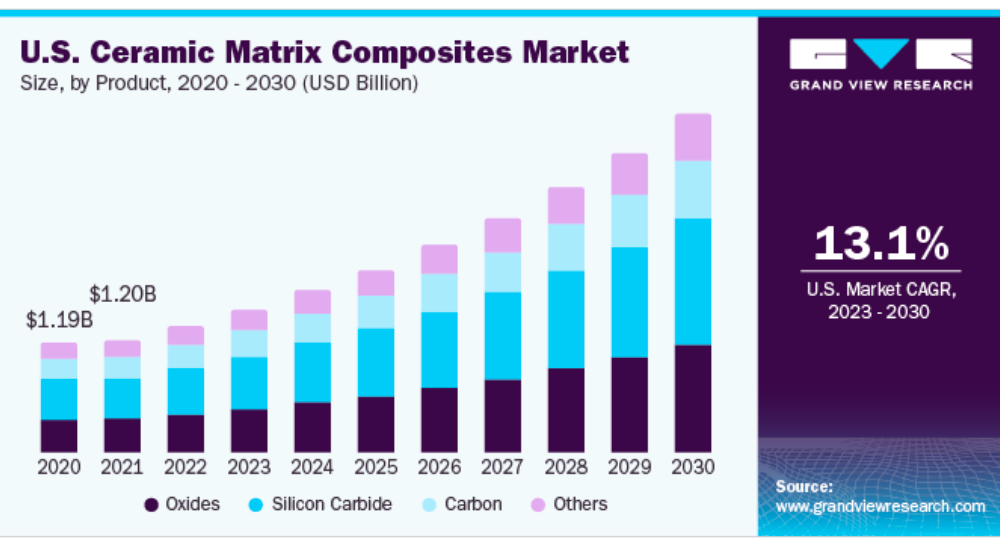

In terms of products, silicon carbide ceramic matrix composites (SiCf/SiC) emerged as the largest product segment in terms of demand in 2018. It accounted for 35.24% of market share by volume. On the other hand, oxide matrix composites are expected to be the fastest-growing product segment over the next seven years. The lower oxide ceramic fibres costs along with their natural oxidation resistance are expected to trigger its demand in aerospace, defence, and energy and power applications.

In geographical terms, North America held the largest market share of 44.78% by volume in 2018. This is due to the presence of major aviation companies, such as Boeing, Bombardier, Airbus Group, and Lockheed Martin, which are known to invest a lot in R&D. In addition, the collaborations with government organizations for upgrading the defence equipment and the implementation of stringent environmental regulations emphasizing the use of lightweight and fuel-efficient materials are some of the major factors contributing to the regional market growth.

However, the Asia Pacific region is expected to emerge as the fastest-growing region in terms of production, due to the competitive advantage linked to low-cost of raw materials and labour. With countries such as China, India, Malaysia, and Thailand, the CAGR rise is anticipated at 14.7% by volume. Given the global energy crisis and the need to shift to renewable resources to secure provision, the Asia Pacific region is exploring alternative sources which include natural gas. CMCs are likely to play a significant role in this transition, with the Energy and power sector anticipated to witness the highest CAGR.

According to Market Data Forecast The European region, like all other regions, was deeply affected by the COVID-19 crisis, which largely expanded through 2021. Both the demand and supply chain were concerned, with delays and missed deliveries of raw materials disrupting both production and application industries. By mid-year, production plants started running at usual capacity and the situation started to improve. Given the strong support being provided by the European Union through the new Horizon Europe Framework and the Green Deal objectives linked to de-carbonisation and the use of renewable, cleaner energies, the market is expected to pick up quickly from where it was before the pandemic.

Specifically, the Europe CMC market is foreseen to grow to 5 billion USD by 2028 with a CAGR of over 10.8% in the outlook period of 2023-2028, and USD 21,6 billion globally, at a CAGR of 10,5%. US CMC market is expected to reach up to 10 billion USD by 2028, with a CAGR of over 8%.

In Europe, the automobile sector is a key driver of the expected growth, due to the rise of electric mobility boosted by the environmental policies promoted in the Union, which increases the need for lightweight but still high-performance materials. The demand for CMCs increased also in the energy sector, noticeably in the wind power sector -especially in the Scandinavian countries-, to be used in the production of different components of the windmills. In line with this information, Markets and Markets forecast that based on the end-use industry, the energy and power segment is estimated to account for the largest market share by 2028, resulting in the fastest-growing application in the next years. This will be a global trend, not only in Europe.

Main players

Although there is not available information on the market share for the most relevant companies operating in the global CMC market, apparently the market is moderately fragmented, so it can be said the market share is divided between several players.

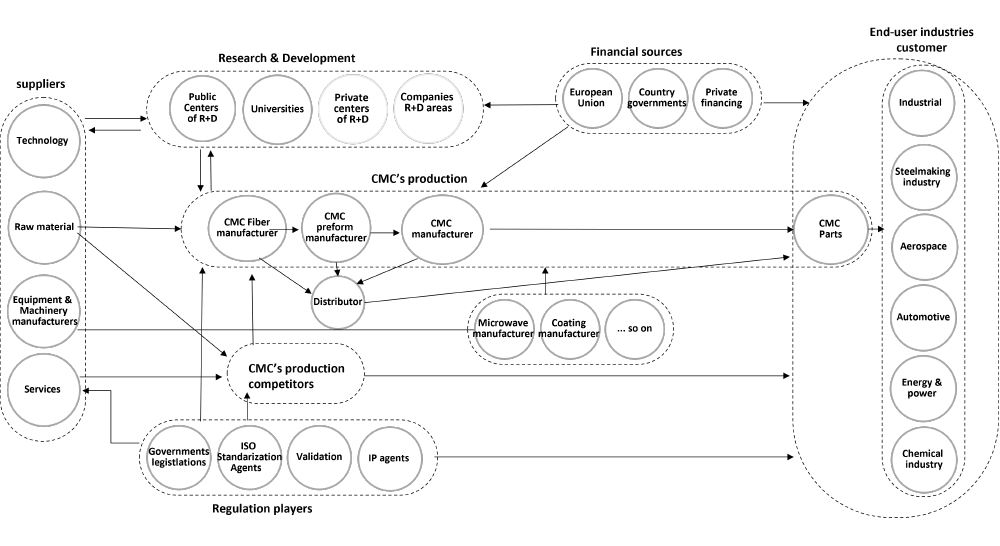

The following figure summarizes the categories of stakeholders within the CMCs market value chain. Research & development:

In the production process of CMCs, there are different functions and roles:

- those who manufacture ceramic fibres from raw materials,

- those who process them in different formats such as row or fabrics,

- those who produce the CMCs preforms and

- those who finally densify them with the ceramic matrix

These processes can be carried out by different actors or companies, or it can be carried out by a single company or alliance of companies, vertically integrating the process. In a search conducted in the spring of 2024, a list of main players in the production of CMCs was developed:

CMCs production:

| COUNTRY | COMPANY1 |

|---|---|

CMC Manufacturers | |

| USA | 3M Applied Thin Films Axiom materials Coi Ceramics Composites Horizons Coors Tek Inc General Electrics Lancer Systems Spirit Aerosystems 4 Ultramet |

| GERMANY | BJS Ceramics GmbH CVT GmbH Schunk Kohlenstofftechnik Walter E. C. Pritzkow Spezialkeramik |

| JAPAN | UBE Corporation KYOCERA Corporation |

| FRANCE | Safran |

| THE NETHERLANDS | HILTEX Semi |

| SOUTH KOREA | DACC Carbon |

| UK | Rolls-Royce plc |

1The official websites of each company have been consulted; the URLs have been included in the references, under the name of the company according to APA format.

2This company is 50% owned by GE Aviation (USA), 25% by Nippon Carbon Fiber (Japan), and 25% Safran (France).

3Japanese company, 50% owned by Nippon Carbon fiber (Japan), 25% by GE Aviation (USA) and 25% Safran (France).

4On July 1st, the acquisition of Spirit AeroSystems by Boeing was announced.

Table title: Main corporate players in the CMC global market. Source: own elaboration, CEM-WAVE project

Market structure

Main players in the CMC market typically develop their strategy at a global level.

On one side, geographical capillarity can be noticed, allowing them to have a presence in different markets with productive, R&D, or commercial units. This capillarity is achieved organically by creating their own centres or inorganically through mergers and acquisitions or joint ventures.

Other strategic alliances are also established between stakeholders to carry out the development of new products, services or technologies in the market, for example through Joint Development Agreements or exploitation rights transfer or licences (related to patents). In general, these alliances seek a) gaining market share, approaching key stakeholders or economic clusters, b) vertically integrating other points of the value chain, c) integrating services with other actors, d) innovation-based collaboration, e) agreements for market landing.

Market trends

A transversal trend in all sectors of activity within the CMCs market is a wide and heterogeneous conception of partnerships, as we saw in the previous section about market structure. The main drivers of these alliances are mostly innovation needs and joining forces to establish themselves in a market characterized by expensive investments and high-performance product requirements. As a result, market concentration seems inevitable.

Sustainability can currently be considered THE trend across all economic activities. This is not different in the CMCs market, even more so considering some of the production burdens, such as the complexity and cost of the manufacturing processes, the associated energy consumption costs, and the related environmental and health implications.

The market is characterized by a rapid evolution based on technological innovation. According to the last market research on CMCs published by Kingpin in January 2024, these innovations span materials, manufacturing and digital technologies. This trend has a narrow relation with incentives to expand the use of CMCs in various regions of the world. These incentives are typically part of broader initiatives, that promote advanced materials and technologies enhancing industrial performance while reducing environmental impact by means, among others, of increasing energy efficiency.

CEM WAVE project can be considered, in fact, a product of the last trend referred to. Its whole concept is based on the sustainability trend, and it has only been possible due to the participation of a range of different actors keen to achieve results based on a collaborative effort.

Kingpin in January 2024, these innovations span materials, manufacturing and digital technologies. This trend has a narrow relation with incentives to expand the use of CMCs in various regions of the world. These incentives are typically part of broader initiatives, that promote advanced materials and technologies enhancing industrial performance while reducing environmental impact by means, among others, of increasing energy efficiency. For more information: